As roofers, we’ve installed thousands of roofs across every imaginable condition—scorching summers, brutal winters, hurricane-force winds, and everything in between. Over the years, we’ve learned which roofing manufacturers consistently deliver quality materials that hold up decades after installation. When homeowners ask us, “Who makes the best roofing materials?”, we don’t give a one-size-fits-all answer. Instead, we point them toward a handful of proven brands that we’ve come to trust through hands-on experience.

Here’s our short list of go-to roofing manufacturers by category:

- Asphalt Shingles: GAF, Owens Corning, CertainTeed, Malarkey Roofing Products, TAMKO, IKO, Atlas

- Metal Roofing: McElroy Metal, Englert, ATAS International, Classic Metal Roofing Systems, CertainTeed

- Flat Roofs/Membranes: Carlisle Construction Materials, Johns Manville, Versico, Holcim Elevate, IB Roof Systems, WeatherBond

- Slate: New England Slate Company, Buckingham Slate, Glendyne, Penn Big Bed

- Cedar Shakes: Waldun Forest Products, Imperial Shake Co., Watkins Sawmills

The right choice depends on your roof type, local climate, budget, and how long you plan to stay in your home. For example, a standing seam metal roof makes sense for a homeowner in a wildfire-prone area who wants 50+ years of service. Traditional asphalt shingles work beautifully for most residential applications where cost and curb appeal need to balance. And working with a certified installer is just as important as the shingle brand on your roof—poor installation can undermine even the best roofing materials.

Why manufacturer choice matters:

- Warranty coverage varies dramatically between brands and product lines

- Durability depends on material composition, thickness, and quality control

- Style options range from basic three-tabs to luxury shingles that mimic slate

- Energy efficiency features like cool-roof coatings can reduce cooling costs significantly

Top Asphalt Shingle Manufacturers

Asphalt shingles cover roughly 70-80% of American homes, and for good reason. They offer an excellent balance of affordability, durability, and aesthetic options. As professional roofers, we recommend established asphalt shingle manufacturers with strong warranties, consistent quality control, and reliable distribution networks.

When we evaluate a shingle brand, we look at several key performance factors:

- Wind rating (130 MPH or higher for storm-prone regions)

- Algae resistance (critical in humid climates)

- Color selection (homeowners want options that complement their siding and neighborhood)

- Impact resistance (Class 4 ratings for hail-prone areas)

- Warranty support (non-prorated periods and transferability)

Below, we’ll profile the leading manufacturers we regularly work with: GAF, Owens Corning, CertainTeed, TAMKO, IKO, Malarkey, and Atlas. Each has earned our trust through years of reliable performance on real roofs.

GAF

GAF is North America’s largest roofing manufacturer, with a history dating back to 1886. Their products protect approximately 1 in 4 American homes—a testament to their market dominance and widespread contractor trust. When homeowners ask about the best roofing options, GAF is often the first name we mention.

What makes GAF stand out:

- Timberline HDZ architectural shingles feature a wide StrikeZone nailing area that helps roofers install faster and with greater accuracy

- Wind ratings up to 130 MPH when installed as a complete roofing system

- Strong algae-resistant options with a lifetime algae resistance warranty on many lines

- LayerLock technology creates a mechanical bond that improves wind resistance

GAF roofs really shine when homeowners invest in their full system approach—ice and water shield, synthetic underlayment, ridge vents, and matching accessories. When installed by GAF-certified contractors, these complete systems unlock enhanced warranty coverage that non-certified installations can’t match.

Best for: Homeowners wanting a proven balance of price, curb appeal, and strong warranty support from an industry leader.

Owens Corning

Owens Corning is a Fortune 500 building materials company founded in 1938, and its pink panther mascot has made it one of the most recognized names in home construction. Their roofing division delivers consistent quality across North America, backed by extensive research and development.

Key product highlights:

- Duration and Oakridge shingle lines offer excellent performance for most residential applications

- SureNail Technology provides a reinforced nailing zone for improved accuracy and 130 MPH wind resistance on Duration options

- Energy Star and “cool roof” options available in select colors for hot, sunny climates

- Industry-leading color blends and online visualization tools help homeowners preview their new roof

From our roofer’s perspective, Owens Corning is a safe recommendation when clients want a widely recognized name backed by solid long-term performance. Their distribution network is excellent, meaning your roofer will rarely face supply delays on jobs.

Best for: Homeowners who value brand recognition, energy efficiency options, and reliable warranties.

CertainTeed

CertainTeed has been manufacturing roofing materials since 1904, building a reputation for premium, heavyweight shingle options that deliver exceptional curb appeal. As a subsidiary of Saint-Gobain, they bring global resources to the American roofing industry.

Product line highlights:

- Landmark architectural shingles provide an affordable upgrade from builder-grade options

- Grand Manor and Belmont luxury shingles mimic the look of slate and wood shake for high-end homes

- The Grand Manor shingle is one of the thickest, most dimensional products that we see

- ‘SureStart’ protection offers strong early non-prorated coverage if material defects occur

CertainTeed consistently produces some of the most visually striking shingles on the market. When curb appeal is the top priority—especially on custom homes or historic renovations—we often reach for their premium lines. They also offer matching accessories and, in some regions, metal roofing options that coordinate with their shingle colors.

Best for: Homeowners who prioritize curb appeal and are willing to invest in architectural or luxury shingles.

TAMKO

TAMKO has operated as an independent, U.S.-based manufacturer since 1944. They’ve built a loyal following among contractors who appreciate their vivid color blends and storm-focused engineering.

Notable products and features:

- Heritage architectural shingles deliver solid performance at competitive price points

- Titan XT line emphasizes enhanced wind performance with ‘Full Start’ non-prorated warranty periods

- Distinctive color blends that stand out in neighborhoods full of standard grays and browns

- MetalWorks steel shingles that mimic slate and wood shake (yes, TAMKO makes metal too)

We often recommend TAMKO when homeowners want distinctive colors and reliable performance without the premium price tag of top-shelf luxury shingles. Their quality control is consistent, and their products have held up well throughout our installations.

Best for: Budget-conscious homeowners wanting distinctive aesthetics and solid storm protection.

IKO

IKO began as a Canadian company in 1951 and has expanded to include manufacturing plants across North America and Europe. Their strong export footprint means they’ve proven their products in diverse climates worldwide.

What we like about IKO:

- Cambridge architectural shingles serve as their flagship line, with excellent dimensional appearance

- Cambridge Cool Colors line complies with ‘California Title 24’ energy requirements

- Cool-color technology provides energy efficiency benefits beyond just white shingles—reducing cooling costs in warm climates

- Competitive pricing in regions with established distribution

From our installer’s perspective, IKO can be a strong value choice where distribution is well-established. Homeowners should check region-specific product availability and warranties, as offerings vary by market. In areas where IKO has a strong presence, it’s absolutely worth considering.

Best for: Value-focused homeowners in regions with strong IKO distribution networks.

Malarkey Roofing Products

Malarkey Roofing Products is a family-owned manufacturer founded in 1956 in Portland, Oregon. Their Pacific Northwest roots have shaped their focus on performance in harsh weather conditions—particularly wet, windy coastal climates.

What sets Malarkey apart:

- SBS polymer-modified asphalt in many lines provides extra flexibility and impact resistance

- Recycled rubber and plastics incorporated into shingle construction

- Vista, Legacy, and Highlander series are designed for demanding climates

- Smog-reducing granules on certain products demonstrate environmental responsibility

- Strong emphasis on shingle recycling programs to reduce landfill waste

Malarkey shingles flex rather than crack in cold temperatures, making them ideal for regions with dramatic temperature swings. From our roofer’s standpoint, Malarkey is a smart choice where storms, high winds, or green building priorities are front and center.

Best for: Homeowners in harsh climates or those prioritizing sustainability and impact resistance.

Atlas Roofing

Atlas Roofing entered the market in 1982 and has built a reputation for innovation in algae resistance and storm performance. Their products are particularly popular in the central and southeastern United States.

Standout features:

- Pinnacle Pristine architectural shingles with Scotchgard Protector prevent black algae streaks in humid regions

- StormMaster lines (StormMaster Shake, StormMaster Slate) carry Class 4 impact ratings for hail-prone areas

- Core4 technology in certain products improves flexibility, granule adhesion, and weather resistance

- Strong focus on rubberized asphalt compounds for enhanced durability

We often recommend Atlas to clients concerned about algae staining or hail damage. If you live in Texas, Oklahoma, or anywhere along the Gulf Coast, or anywhere that sees regular severe weather, Atlas deserves serious consideration.

Best for: Homeowners in humid or hail-prone regions wanting superior algae and impact resistance.

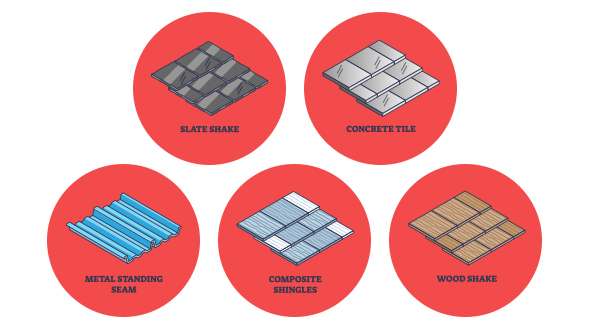

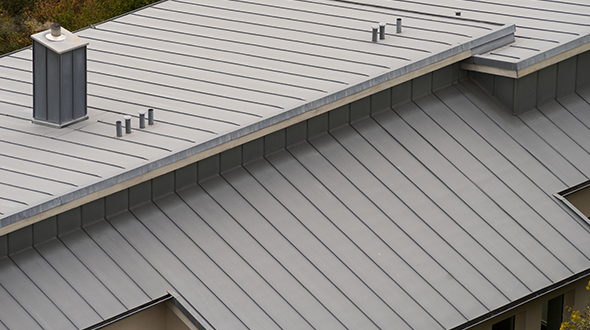

Top Metal Roofing Manufacturers

Metal roofing has surged in popularity as homeowners and commercial property owners discover its remarkable benefits: 40-70 year lifespans, superior fire resistance, excellent energy efficiency, and minimal maintenance requirements. While the upfront cost exceeds that of asphalt, metal roofing often pays for itself through durability and reduced energy bills.

Common metal roof types we install:

- Standing seam panels (concealed fasteners, clean lines)

- Through fastened panel systems (exposed fasteners, cost-effective)

- Stone-coated steel shingles (metal durability, traditional appearance)

- Stamped metal panels that mimic slate, tile, or wood shake

The following profiles cover the metal roofing manufacturers we trust for residential and commercial projects: McElroy Metal, Classic Metal Roofing Systems, Englert, ATAS International, and CertainTeed’s metal offerings.

McElroy Metal

McElroy Metal has manufactured metal roofing systems since 1963, with multiple production facilities and metal marts strategically located across the United States. This network means reliable distribution and manageable lead times on most projects.

What we appreciate about McElroy:

- Extensive range of profiles: standing seam, exposed fastener, and stone-coated steel products

- Both residential and commercial solutions, including retrofit “metal-over-metal” and “metal-over-shingle” systems

- Consistent panel quality and color matching across production runs

- Products engineered for heavy snow loads, high winds, and long-term, low-maintenance performance

From our roofer’s perspective, McElroy’s consistent job-to-job performance gives us confidence recommending their products. When a homeowner wants metal roofing materials that will perform for decades with minimal attention, McElroy delivers.

Best for: Homeowners and commercial property owners wanting reliable metal panels with strong distribution support.

Classic Metal Roofing Systems

Classic Metal Roofing Systems has specialized in premium residential metal roofs since approximately 1980. Their focus on aesthetics sets them apart—these are metal roofing systems designed to look beautiful, not industrial.

Product highlights:

- Aluminum and steel shingles that convincingly mimic cedar shakes, slate, and tile

- Product lines like Country Manor Shake, Rustic Shingle, and metal tile profiles

- High recycled content (often 95-99% recycled aluminum in many products)

- Energy-saving coatings and finishes that reflect solar heat

- Proven track record in hurricane-force winds and hail conditions

We tend to propose Classic on projects where homeowners want a custom look and plan to stay in their home for decades. The upfront investment pays dividends through durability and durable solutions that outlast the competition.

Best for: Homeowners wanting premium aesthetics with metal’s longevity—ideal for forever homes.

Englert

Englert has been a leading roofing manufacturer of standing seam metal panels and gutter systems since 1966. Their focus on architectural applications makes them a favorite for projects where clean lines and color options matter.

Key strengths:

- An extensive list of Energy Star-compliant colors and LEED-friendly coatings

- On-site roll-forming capabilities allow us to deliver long, continuous panels directly to the jobsite

- Reduced seams mean fewer potential leak points

- Excellent technical support and detailed installation specifications

From a contractor’s view, Englert’s willingness to support installers with training and documentation makes complex standing seam projects more manageable. Their batten seam and architectural profiles work beautifully on both residential and commercial buildings.

Best for: Architectural projects requiring standing seam panels with extensive color options.

ATAS International

ATAS International is a family-owned metal panel manufacturer founded in 1963. Their broad catalog includes solutions for both roofing and wall applications, making them ideal for integrated designs.

What makes ATAS stand out:

- Wide array of profiles: standing seam, batten seam, tiles, shingles, and curved/tapered panels

- Strong reputation for color selection and architectural-grade finishes

- Products used on both residential homes and commercial buildings

- Participation in green building programs supporting sustainable project goals

We like ATAS when designs call for unusual shapes, curves, or mixed metal wall/roof systems. Their engineering support helps us execute complex architectural visions that other manufacturers might struggle to deliver.

Best for: Architectural projects with unique design requirements or mixed metal applications.

CertainTeed Metal Roofing

CertainTeed complements its extensive shingle lineup with metal roofing products that mimic slate, wood, and clay tile. These stamped metal systems deliver a premium look without the weight of natural materials.

Benefits of CertainTeed metal:

- Coordinate colors between shingle and metal sections on complex roofs

- Premium appearance without structural reinforcement required for real slate

- Single manufacturer simplifies warranty discussions and accessory selection

- Excellent option for homeowners who love CertainTeed but want metal’s longevity

From our roofer’s perspective, working with a single manufacturer for mixed-material roofs streamlines the entire project. CertainTeed’s metal lines are particularly attractive for additions or dormers where matching existing shingle colors matters.

Best for: Homeowners wanting to combine CertainTeed shingles with metal accents or transitions.

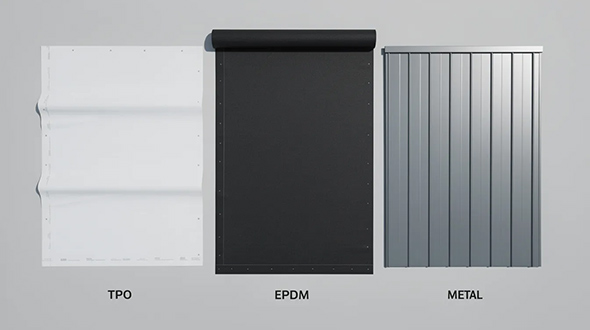

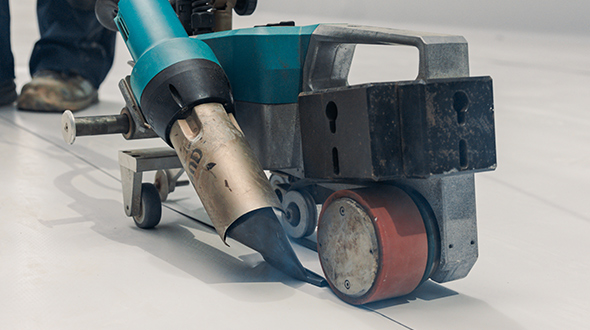

Top Flat & Single-Ply Membrane Roofing Manufacturers (EPDM, TPO, PVC)

Flat and low-slope roofs require specialized membrane roofing manufacturers who understand the unique challenges of horizontal surfaces. Whether it’s a commercial warehouse, a residential addition with a flat roof, or a rooftop deck, these roofs need waterproof membrane systems that can handle ponding water, UV exposure, and decades of thermal cycling.

What we look for in membrane roofing:

- Long-term weathering performance (25+ years)

- Seam strength and weldability

- Ease of installation and detail work

- Strong manufacturer technical support and training programs

The following profiles cover the membrane roofing manufacturers we trust: Carlisle SynTec, Johns Manville, Versico Roofing Systems, Holcim Elevate, IB Roof Systems, and WeatherBond.

Carlisle SynTec (Carlisle Construction Materials)

Carlisle Construction Materials operates one of the longest-standing single-ply roofing divisions in the industry, with roots stretching back to the mid-20th century. Their reputation for quality has made them a go-to specification on major commercial projects across North America.

What Carlisle offers:

- Complete range of EPDM, TPO, and PVC membranes

- Insulation, air barriers, and vapor barriers for complete roof assemblies

- Extensive contractor training and certification programs

- Decades of real-world performance data on thousands of installations

We rely on Carlisle’s training programs to stay current on best practices and new products. When building owners want proven roofing systems backed by industry-leading research, Carlisle is our first recommendation.

Best for: Commercial and institutional projects requiring proven, well-documented roof systems.

Johns Manville

Johns Manville traces its history to 1858 and now operates as a Berkshire Hathaway company. Their commercial roofing division offers a comprehensive range of products for flat roofs of all sizes.

Product range:

- EPDM, TPO, and PVC membranes in various thicknesses and colors

- Built-up and modified bitumen systems for specific applications

- Cool-roof membranes that meet energy codes and reduce cooling costs

- Integrated insulation products for complete thermal performance

We lean toward Johns Manville on projects where the specifications call for a complete, integrated roof assembly from a single manufacturer. Their technical support for design details and installation guidance is excellent.

Best for: Projects requiring comprehensive single-manufacturer solutions with strong warranty support.

Versico Roofing Systems

Versico operates as part of the Carlisle family, focusing heavily on EPDM, TPO, and PVC single-ply roofing for commercial and residential applications. Their products share Carlisle’s quality standards while offering distinct product lines.

Versico advantages:

- Multiple membrane thicknesses, colors, and attachment methods (fully adhered, mechanically attached, ballasted)

- Contractor-friendly installation details and documentation

- Long-term warranties when installed by authorized contractors

- Strong presence on mid-sized commercial and residential flat roofs

From our roofer’s perspective, Versico hits a sweet spot for projects that don’t require the full scale of Carlisle’s commercial systems but still need premium quality.

Best for: Mid-sized commercial and residential flat roof projects.

Holcim Elevate (formerly Firestone Building Products)

Holcim Elevate represents the rebranded Firestone roofing division, bringing more than 40 years of commercial roofing expertise. Their signature red branding is recognized on warehouses, retail buildings, and industrial facilities worldwide.

Strengths of Elevate:

- Well-established EPDM, TPO, and PVC product lines

- Proven durability on large flat roofs across diverse climates

- Detailed technical manuals and accessory systems that simplify complex details

- Global brand recognition and extensive performance history

As roofers, we appreciate Elevate’s documentation—their detailed drawings and technical manuals make tricky flashing conditions much more straightforward. For owners wanting a globally recognized brand, Elevate delivers.

Best for: Large commercial and industrial flat roof projects requiring proven systems.

IB Roof Systems

IB Roof Systems has specialized in PVC roofing since 1978, with particular strength in coastal and high-moisture regions where PVC membranes excel. Their focus on quality has earned them a loyal following.

Why IB stands out:

- 50 mil and thicker PVC membranes that exceed industry durability standards

- IB White PVC membrane is highly reflective and Energy Star-qualified

- Excellent performance in hot climates with superior seam strength

- Extended material warranties (often 25+ years) when installed by approved contractors

From our hands-on experience, IB is a favorite for residential low-slope roofs, condos, and light commercial projects where long warranties and proven performance matter. Their coastal track record is particularly impressive.

Best for: Residential and light commercial flat roofs in hot or coastal climates.

WeatherBond

WeatherBond has operated as a Carlisle subsidiary since 2006, focusing on streamlined single-ply systems for contractors who want simplified ordering without sacrificing quality.

WeatherBond benefits:

- EPDM, TPO, and PVC systems with straightforward product lines

- Carlisle quality with streamlined ordering and packaging

- Limited lifetime material warranties on some residential systems

- Extended warranties are available through the Recognized Contractor program

We often see WeatherBond specified on residential flat roofs, small commercial buildings, and re-roof projects. Homeowners should confirm their installer is approved for the specific WeatherBond warranty level they want.

Best for: Residential flat roofs and small commercial projects wanting Carlisle quality with simplified options.

Top Slate Roofing Manufacturers

Natural slate represents the pinnacle of roofing longevity and beauty. A properly installed slate roof can last 75-150+ years, outliving multiple generations of homeowners. The material’s natural variation creates stunning visual effects that no manufactured product can truly replicate.

However, slate is heavier and more expensive than other roofing materials. Your home’s structure must support the added weight (typically 800-1,500 pounds per square), and installation requires artisan-level skill. When these conditions are met, slate roofing delivers unmatched value over its service life.

The following slate roof manufacturers have earned our trust for consistent quality and long-term performance.

New England Slate

New England Slate Company has operated in Vermont’s historic slate region since the 1970s, producing some of the finest roofing slate available in North America.

What we value about New England Slate:

- ASTM S1-rated slates with warranties often exceeding 75 years

- Color variety, including greens, grays, purples, blacks, and blends

- Custom sizes, thicknesses, and shapes for complex roofs and historic restorations

- Vermont’s geological heritage produces exceptional slate density

From our perspective, New England Slate Company is a go-to when clients want authentic Northeast slate with a proven track record. Their willingness to work with us on custom orders makes historic restoration projects much smoother.

Best for: Traditional New England architecture and historic restoration projects.

Buckingham Slate

Buckingham Slate comes from Virginia quarries that have produced dense, unfading blue-black slate since the 19th century. Many consider it the finest American roofing slate available.

Buckingham characteristics:

- Life expectancy up to 150 years or more

- Low water absorption and excellent acid resistance

- Dense composition that resists weathering exceptionally well

- Often specified on landmark buildings, universities, and high-end custom homes

The cost of Buckingham Slate is premium, but so is its longevity and historic prestige. When clients are building their forever home or restoring a significant property, Buckingham is worth every penny.

Best for: Landmark buildings, prestigious institutions, and ultra-premium custom homes.

Glendyne

Glendyne produces Canadian slate known for its dark gray color with a subtle blue cast. Their quarries focus on consistent quality and modern production standards.

Why we recommend Glendyne:

- Slate free of pyrite and metal intrusion that prevents rust staining

- Service life estimates in the 100-year range when installed correctly

- Consistent sizing and uniform splitting for efficient installation

- Modern, sophisticated appearance that works well on contemporary architecture

Glendyne’s uniformity and predictable splitting is their advantage. This consistency makes installation more efficient while ensuring a beautiful finished roof.

Best for: Projects requiring consistent, modern-looking slate with excellent durability.

Penn Big Bed Slate

Penn Big Bed Slate has operated in Slatington, Pennsylvania, since the 1930s, continuing the region’s proud “Slate Belt” heritage that dates to the 1800s.

Penn Big Bed offerings:

- Both clear and “ribbon” slates in various grades

- Service lives often exceed 150 years

- Range of sizes and thicknesses for diverse applications

- Extensive use on historic restorations and traditional new construction

From an installation standpoint, we see Pennsylvania slate as a classic choice for traditional American architecture. England Slate and other Pennsylvania producers have supplied countless iconic buildings, and Penn Big Bed continues that legacy.

Best for: Historic restorations and traditional American architectural styles.

Top Cedar Shake & Wood Roofing Manufacturers

Cedar shakes and shingles offer a natural, high-end roofing option prized for their distinctive texture, excellent insulation properties, and the beautiful silver-gray patina they develop over time. A quality cedar roof can last 30-50 years with proper maintenance.

We insist on mills with tight quality control and proper treatment options to maximize lifespan and fire resistance (where local codes permit wood shake roofing). The following manufacturers produce cedar products that we trust for premium installations.

Waldun Forest Products

Waldun Forest Products has been one of the largest and most respected cedar shake and shingle mills in British Columbia since the 1970s. Their products set the industry standard for quality.

What makes Waldun exceptional:

- Premium production of split, resawn, and tapersawn shakes

- Available in premium, #1, and standard grades

- Lengths commonly available in 16, 18, and 24 inches for different roof pitches

- Extended warranty options on certain products reflect confidence in quality

From our perspective, Waldun’s consistency makes installation smoother and helps the roof weather evenly over time. When clients want the best cedar available, Waldun is a first call.

Best for: Premium residential projects where cedar quality and longevity are paramount.

Watkins Sawmills

Watkins Sawmills has manufactured cedar shakes and shingles in British Columbia since 1947. Their scale and experience make them a reliable source for projects of any size.

Watkins advantages:

- Wide selection of certified and uncertified cedar products

- Grades ranging from rustic to select for different aesthetic goals

- Reliable supply for large, complex roofing projects

- Long history of consistent production

Pairing Watkins cedar with proper underlayment and ventilation is key to achieving the longest possible service life. When maintained correctly, these roofs develop the beautiful weathered appearance that makes cedar so desirable.

Best for: Large residential projects and commercial applications requiring a consistent cedar supply.

Imperial Shake Co.

Imperial Shake Co. was founded in 1998 in Maple Ridge, B.C., focusing exclusively on high-quality Western Red Cedar shakes. Their attention to quality control from raw log to finished product shows in every bundle.

Imperial Shake features:

- 18” and 24” lengths are typically available

- Strict quality control throughout production

- Products exported internationally for premium projects

- Consistent grading that makes installation predictable

Based on our experience, Imperial Shake is a strong choice for clients who want top-tier, uniform cedar for custom homes. As with all cedar, local fire and building codes must be verified before selecting wood shake roofing.

Best for: Custom homes where a uniform, premium cedar appearance is desired.

How We Choose the Right Manufacturer for Each Roof

As professional roofers, we don’t believe in a single “best” manufacturer. The right choice depends on your roof type, climate, budget, architectural style, and how long you plan to stay in your home.

Our process starts with a thorough roof inspection and conversation about your priorities. How long do you plan to stay? What weather risks does your area face—hail, hurricanes, heavy snow? What aesthetic style fits your home and neighborhood? What’s your budget for this investment?

Based on these answers, we match homeowners to manufacturers:

- Asphalt shingles serve most budgets and perform well across diverse climates

- Metal roofing delivers superior longevity, fire resistance, and energy conservation

- Natural slate creates legacy roofs for homes meant to last generations

- Cedar shakes offer unmatched character and natural insulation

- PVC membranes and other membrane systems protect flat roofs reliably

Key decision factors to discuss with your roofer:

- Wind and hail ratings appropriate for your region

- Algae resistance requirements for humid climates

- Energy efficiency features for reducing cooling costs

- Warranty terms, including non-prorated periods and transferability

- Local material availability and lead times

- Certified installer requirements for enhanced warranties

- Total investment including proper underlayment, flashing, and ventilation

Mini-checklist for manufacturer discussions:

- [ ] What wind rating do I need for my area?

- [ ] Is algae resistance important in my climate?

- [ ] Do I want energy-efficient options?

- [ ] How long do I plan to live in this home?

- [ ] What warranty coverage matters most to me?

- [ ] Is my installer certified by this manufacturer?

Working with a Professional Roofer vs. Going by Brand Name Alone

Even the best manufacturer can’t save a roof from poor installation. We’ve seen premium shingles fail within 5 years due to inadequate ventilation. We’ve replaced “lifetime” roofs that leaked from day one due to improper flashing. The roofing products matter, but installation quality matters just as much.

This is why manufacturer certification programs exist. GAF, Owens Corning, CertainTeed, Malarkey, and other leading manufacturers offer training and certification for roofing contractors who meet their standards. Using a certified installer often unlocks enhanced warranty coverage that non-certified installations simply can’t access.

Our typical installation process includes:

- Thorough inspection of the existing roof structure and decking

- Product recommendations from several top manufacturers based on your needs

- Written proposal detailing materials, labor, timeline, and warranty information

- Step-by-step installation, including underlayment, flashings, and ventilation

- Final walkthrough and warranty documentation

What to look for in a roofing contractor:

- Current proof of insurance (liability and workers’ compensation)

- Valid state and local licensing

- References from recent projects

- Manufacturer training badges and certifications

- Detailed written proposals and warranties

- Clear communication throughout the project

Brand reputation is a good starting point, but lean on a trusted local roofer to choose the exact product line and complete system that fits your home. A certified installer knows which products perform best in your specific climate and can ensure your new roof is installed correctly for maximum longevity.

Choosing the Top Roofing Manufacturer for Your Roof

The “top” manufacturer is ultimately the one whose roofing products match your roof’s design, your local climate, and your long-term plans—installed by a qualified roofing contractor who follows manufacturer specifications. There’s no universal winner because every roof presents unique requirements.

The brands we’ve covered—GAF, Owens Corning, CertainTeed, Malarkey, McElroy, Englert, Carlisle, New England Slate, Waldun, and the other leading manufacturers—are all names we trust on real jobs. We’ve installed their products through heat waves and ice storms, and they’ve performed as promised. That’s why they’ve earned spots on our go-to list.

When planning your new roof, focus on the complete roofing system rather than just the visible surface. The underlayment, ventilation, flashings, and accessories all work together to protect your home. Cutting corners on any component compromises the entire investment.

If you’re ready to explore your roofing options, we invite you to schedule an inspection with a qualified local roofer. We’ll assess your current roof’s condition, discuss your priorities and budget, and recommend the manufacturer and product line that best suits your specific situation. Your roof protects everything beneath it—choosing proven roofing solutions installed by experienced professionals ensures that protection lasts for decades to come.

(404) 220-9288